Your credit score plays a huge role in your financial life. The digit here is a three-digit number which tracks all your money transactions. Checking is done by the lenders anytime you request them to lend you some money. They would have an interest in whether you will give them back on time.

A good score gives them an entry into the world of improved bargains and reduced expenses. You shall find it easier to hire flats or to take up contracts for mobile phones. Your score is higher, and this makes you less risky to lenders.

Bad scores tell another story to the banks and credit card companies. They may refuse to grant your loan and mortgage requests. Provided they accept you, you will pay more interest. There may be lenders who require an increased amount of deposit before they would deal with you.

What Is Considered a Bad Credit Score in the UK?

Your credit score matters more than you might think. In the UK, three main credit reference agencies track your borrowing habits and payment history. Each uses their own system, which can be confusing at first glance.

- Experian, the largest agency, marks scores below 721 as poor. If you fall under 561, they’ll classify you as very poor. These numbers tell lenders you might struggle with repayments.

- Equifax works differently, using a scale that tops at 700. They consider anything below 380 as poor credit. Their system looks at similar factors but weighs them uniquely.

- TransUnion, the third major player, sets their poor rating at below 566. They check your credit use and payment patterns just like the others.

This agency collects slightly different data and uses its own calculations. Here are some of their collective features:

- Not all lenders report to all three agencies

- Free credit reports are available yearly from each agency

- Most banks use Experian for initial checks

- Credit scores can vary by up to 100 points between agencies

- Your score changes monthly as new data comes in

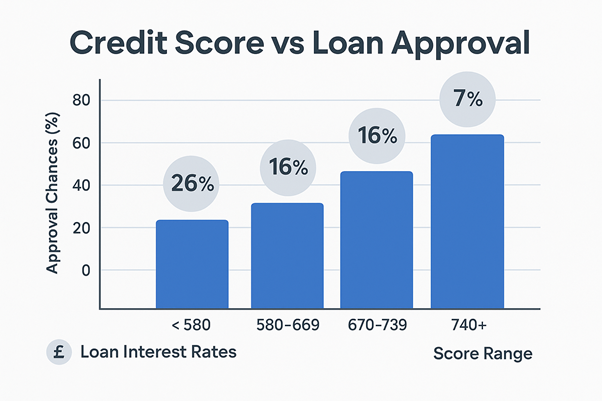

|

Comparison of Credit Score Impact on Loan Approval | ||

|

Credit Score Range |

Approval Chance |

Typical Interest Rate |

|

Excellent (900+) |

Very High |

3%–5% |

|

Good (750–899) |

High |

6%–9% |

|

Fair (600–749) |

Moderate |

10%–15% |

|

Poor (450–599) |

Low |

18%–25% |

|

Very Poor (<450) |

Very Low |

May not qualify |

Main Causes of a Bad Credit Score

Your financial habits tell a story that lenders can read through your credit report. Many people don’t realise how everyday choices affect their credit standing.

1. Missed or Late Repayments

Paying bills late damages your credit health faster than almost anything else. A single missed payment can drop your score significantly. The lenders view this pattern as a red flag about your reliability. The impact gets worse when payments remain overdue for longer periods. Your payment history makes up about 35% of your total score.

2. High Credit Card Utilisation

Maximum spending on cards gives alerts to future lenders. The percentage of available credit that you have to use is not more than 30. The credit scoring models examine you to the limit. A person who has paid £900 on a limit of £1,000 will appear risky compared to others. This is what influences almost a third of your total credit score.

3. Defaults and CCJs

This occurs following a series of missed payments, typically between 3 and 6 months. A County Court Judgment remains on your credit report up to six years. Such legal marks demonstrate that you never repay debts as per the agreement. These are huge red flags to the lenders concerning lending to you.

4. Frequent Credit Applications

Applying for multiple loans or cards creates hard searches on your file. Each application suggests you might be desperate for credit. The lenders wonder why you need money from several sources at once. Space out applications by at least three months when possible. This prevents your score from dropping with each new inquiry.

5. Electoral Roll Absence

The lenders use electoral information to confirm your address and identity. Without this basic verification, they question your reliability. Registration takes just minutes online, but improves your score immediately.

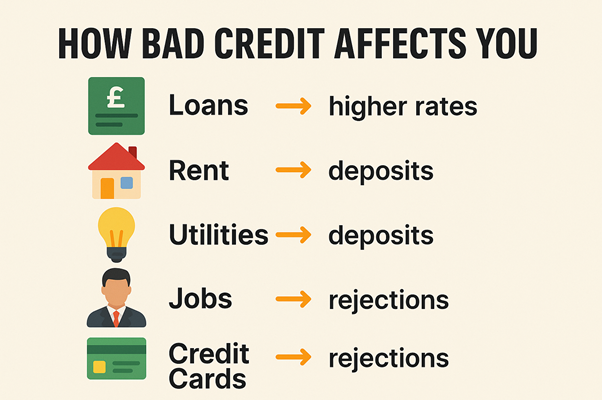

How a Bad Credit Score Affects You?

Bad credit creates roadblocks you’ll feel in everyday life. Mortgage lenders often turn away scores below the “fair” range.

Insurance companies check your credit. Some ask for hundreds of pounds upfront instead of monthly payments. The credit card companies reserve their best deals for good credit holders. You’ll miss low interest rates and rewards programs. The cards available to you might charge 30% interest or more.

The landlords increasingly screen tenants based on credit history. A poor score can lock you out of properties you love. Some ask for six months’ rent in advance to offset their risk.

Job hunting? Some employers peek at credit reports during background checks. They view poor credit as a sign of unreliability. This happens mostly in the financial sector.

You can improve your credit score with time and effort.

- Setting up direct debits prevents missed payments

- Staying below 30% of available credit helps scores climb

- Registering to vote adds you to the electoral roll

- Checking for errors on your report can boost scores instantly

- Avoiding multiple credit applications prevents further damage

Ways to Improve a Bad Credit Score

Your small, consistent changes add up to significant improvements over time.

1. Timely Payments

You can set up direct debits for minimum payments at the very least. This prevents costly late fees and protects your score from damage. Your payment history influences your rating more than any other factor.

2. Managing Credit Utilisation

You can keep card balances low compared to your credit limits. Aim to use less than 30% of available credit. Paying down existing balances often boosts scores within weeks. You can consider making payments twice monthly instead of waiting for statements.

3. Electoral Roll Registration

Nowadays, you can enrol to vote on the site of your local council. This is just a quick measure of lenders to prove your identity and address. Of course, there is an improvement in scores after registration. The lenders examine this when they scrutinise the applications.

4. Report Accuracy

You should revise your file on a regular basis to make sure there are no errors which could negatively affect your grading. Mistakes do occur more frequently than you may imagine. Any misleading information should be disputed with the agencies as soon as possible. Any single missed late payment will reduce the scores in an unjust manner.

5. Smart Credit Applications

You apply eligibility checkers prior to the application of new credit accounts. These will indicate approval opportunities with no score change. You only apply for short term loans when absolutely necessary.

|

Myths vs Facts About Bad Credit | |

|

Common Myth |

Actual Fact |

|

Closing accounts helps score |

It can actually lower the score |

|

Checking your score lowers it |

Soft checks don’t affect score |

|

Debit cards build credit |

Only credit products do |

|

Paying off loans removes defaults |

Defaults stay up to 6 years |

How Long Does It Take to Repair Bad Credit?

Your timeline depends largely on what damaged your score in the first place. Minor credit issues can show improvement in just 3-6 months. Late payments that you quickly catch up on won’t haunt you for long. Making steady repayments on existing accounts sends positive signals to lenders. Your score can climb steadily with each passing month.

Serious black marks stay visible much longer on your file. Defaults, missed payments, and County Court Judgments remain for six years. These items drag your score down even as you build better habits. The clock starts from the date of the default, not when you settle it.

You can still access credit while rebuilding your financial standing. Some lenders offer loans to people with a bad credit score. These loans often come with higher interest rates, but are reported to credit agencies.

There is no legitimate service that can erase accurate negative information overnight. Many companies promising instant credit repair usually charge fees for things you could do yourself.

Quickloanslender understands the challenges of credit repair journeys. They provide lending options that consider your current situation, not just past mistakes. Their customers often see gradual improvements while meeting monthly obligations. You can check your statements regularly and keep balances low on cards.

Conclusion

You check your report regularly to catch problems early on. The effort pays off when you qualify for lower interest rates. This could save you thousands of pounds over the years. You don’t get discouraged by setbacks on your credit journey. You focus instead on the progress you make each month.

Emma Anderson is a financial advisor at Quickloanslender who always believes in researching hard to know her clients’ financial problems. She takes the time to understand their financial wants and needs to write the blogs on them as the solutions. In her long 14 years of experience, she has written plenty of blogs on the financial and business sectors of the UK.

Emma Anderson has been recognised for her work in financial planning and her blogs are regularly published in the website of Quickloanslender. As far as her educational qualification is concerned, she has done Masters in Accounting and Finance, and done PG Diploma in Creative Writing.