Car finance soft search – when you borrow without search footprint

Do you want to buy a car but also want to avoid hard search process? If yes, then car finance with soft search is the right financial tool for you to exploit the exact benefit of borrowing without any mark. Quickloanslender has this finance option for the borrowers going through varied tough financial conditions in their personal life. The facility is available for new as well as a used car. If you are in the list of such car buyers, we are RIGHT HERE to help you.

What type of borrowers takes car finance soft search?

Soft search/soft credit check is used to avoid hard check, and the applicants require that in certain types of financial conditions. It is essential to mention what kind of financial situations, and borrowers ask for soft search car finance.

- Bad credit borrowers – People with poor credit history do not want any search footprint. Rejection can reduce their chances for further applications. It is the reason that people seek car finance for bad credit soft search.

Soft check is easily available but hard check helps us know your finances better and customize better.

- No credit history – Those with no credit in life do not want credit check because it is a negative factor for the car loan lenders. Search footprints when there is already no credit record can be hazardous.

- Bankrupt & IVA borrowers – As you can understand, it is challenging to let more search procedures harm your financial records if you are bankrupt. For no credit check, we need the confirmation from you insolvency practitioner.

- Count Court Judgement borrowers – CCJ is a direct indication of a worst-case scenario in personal finances, and no one can want to make the issue intense with a credit check. The car finance applicant should present proof for debt settlement.

Note – If you fail to justify your poor financial condition and show a repaying capacity, it might be not easy to process your application further. In the case of used cars, you need to keep extra caution because the vehicle's condition can add more concerns.

How soft search works?

Soft check works on the overall glance at the current financial circumstances of the borrower. Unlike the hard check, it does not scrutinise the past of your financial life. There is no concern for past debt and bill payment records. Everything works on current times.

- The two most important factor in soft search is –

- Current income status/Repaying capacity

- Recent bill and debt payments

- With imperfect current financial conditions, you cannot qualify for no credit check.

- A soft check is available only on short-term and medium-term finance options.

- Soft credit record perusal is not subject to any additional fee or charges.

Besides the benefits mentioned above, the borrower will also get promising alternatives to other counterparts of doorstep loans like greenwoods doorstep loans or provident personal credit.

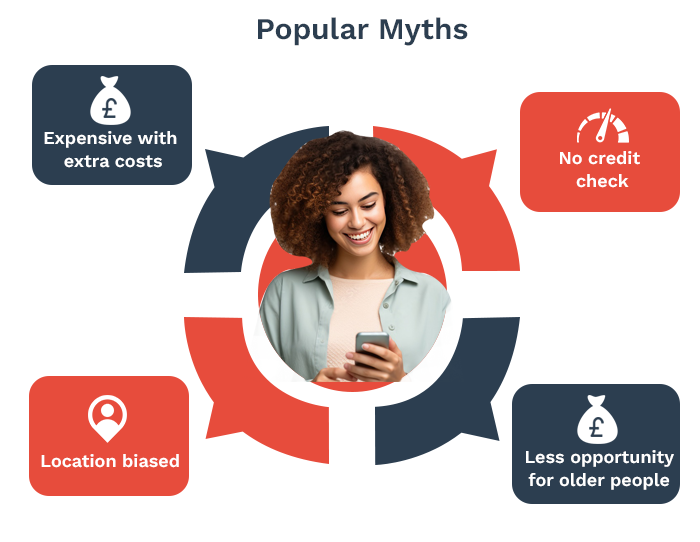

Myths about soft credit search for car finance

We frequently interact with many customers who have several misconceptions about the soft search process. Due to ignorance and incomplete knowledge, they fail to see the reality behind the scene. It makes them the prey for wrong financial decisions and chooses an unsuitable car finance option. We debunk some of the myths about the soft credit check in particular reference to car finance.

-

You need a broker to get car finance with no credit check

This is not serious and not real. It is just a myth that unnecessarily drives people to obtain the help of broking companies. One can easily find a soft search lender online. A broker comes with the hefty cost of brokerage, which takes away lot of money from your pocket.

-

Soft credit check finance deals are expensive with extra costs

This myth breeds from another myth that says, you need to pay extra to borrow money on a soft credit check. But it is much far from reality. According to the lending rules, a lender cannot charge any fee from the borrower for not doing the hard check.

-

You need a broker to get car finance with no credit check

This is not serious and not real. It is just a myth that unnecessarily drives people to obtain the help of broking companies. One can easily find a soft search lender online. A broker comes with the hefty cost of brokerage, which takes away lot of money from your pocket.

-

Soft credit check finance deals are expensive with extra costs

This myth breeds from another myth that says, you need to pay extra to borrow money on a soft credit check. But it is much far from reality. According to the lending rules, a lender cannot charge any fee from the borrower for not doing the hard check.

-

Soft credit score perusal can be location biased

Again, a wrong perception that is unfortunately prevalent. Yes, finance companies are sometimes biased on location in fund approval. The small towns with weaker economy get lesser attention of the lenders. However, this is not with us. Besides, a soft check is just a method, and a soft credit search for car finance has no location constraint.

-

Older people cannot get a soft search facility

This is entirely case-based, and there is no age constraint. As long as the applicant has a satisfying repaying capacity, one can get this. The same type of myth is popular about self-employed car finance because their income is something difficult to justify. But, there also the individual circumstances are decisive.

Quickloanslender can commit to you best experience of soft check process without making the process complicated. The car finance is available 24x7 on soft search if you have a strong repaying capacity. You are the final decision maker because stronger you keep your finances, easier it is to qualify for the soft search process.