A guaranteed loan is a borrowing option that borrowers use to obtain funds online for short-term to mid-term financial purposes. These are called guaranteed loans because the guarantor plays an essential role in the loan process. The guarantor makes it easy for you to get a bigger loan amount at a lower rate of interest. However, besides that income, employment stability, and a verified address of the loan applicant are decisive factors.

In case a borrower is not able to find a guarantor, still, funds can be borrowed based on the applicant's repayment capacity. Whether a guarantor is present or not, loans can be availed irrespective of credit score status and employment or income type. However, the borrower may have a poor credit history or even no credit history.

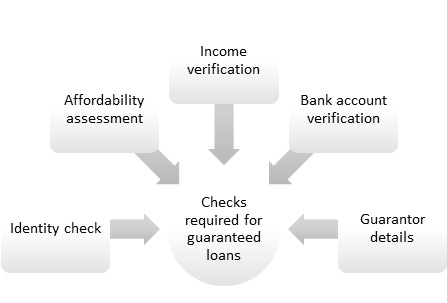

But the one who is supporting the primary applicant needs to have a good credit history. Stable income and a perfect debt-to-income ratio are other factors. This helps the fund seeker qualify for the 100% guaranteed loans. It means the approval of the loan is assured as per the joint repayment ability of the applicant and the guarantor.

Are you struggling to borrow money for a purpose? Consider taking loans with guaranteed approval through a speedy online process. Quickloanslender offers online loan solutions for short-term to mid-term needs. You can borrow without the fear of hidden fees. We reveal the APR upfront and also provide flexible repayment plans for easy guaranteed loan approval. You can also check for eligibility through a soft check process.

The guaranteed acceptance loans are processed through a straightforward online loan process. The complete procedure takes only a few minutes if you have all the required details ready to submit for the online application form. A few steps are needed to borrow funds.

By following the above procedure properly, you can even qualify for the guaranteed payday loans. A small amount for a last-minute emergency is attainable as per your salary or earning capacity. In case of a payday, we transfer funds in an hour.

This loan is like guaranteed loans from direct lender only where it is important for the applicant to have a guarantor. Along with the applicant’s creditworthiness, guarantor’s credit purchase power is also calculated. However, in a guaranteed loan, you have an option to borrow funds on your repayment capacity. But in a guarantor loan, it is vital to include a guarantor.

Due to adding repayment capacity of two persons for a loan application, approval becomes easy. This is why, borrowers consider that the loans with a guarantor are guaranteed. However, forget not, the factor of affordability is always applicable.

Rationally, no lending company can ever guarantee an approval. It is the strong credit purchase power of the applicant and the guarantor that getting the funds become effortless. As per your financial circumstances, you can apply for any of these loans.

As we always mention, approval cannot be guaranteed ethically, payback ability is a decisive factor.But yes, if you manage to prove a strong repayment capacity, it is simple to qualify for the guaranteed loans for bad credit from a direct lender. If you are applying for guaranteed loans with a poor credit score, take care of a few factors.

Tips to apply for guaranteed loans with a bad credit score –

A pre-approved loan is an estimate of the loan amount, interest rate and monthly payments you qualify for. You can check it using a free eligibility calculator or loan calculator. For many reasons, getting a pre-approved offer on the guaranteed approval loans from a direct lender is beneficial.

Several risks are connected to guaranteed borrowing solutions. However, these are the challenges that inspire responsible borrowing behaviour. Also, it is advisable to check eligibility through guaranteed loans with no credit check. This needs only a soft check, and you can get the idea of your loan offer.

By following several dos and don'ts, you can easily qualify for a guaranteed loan irrespective of the purpose of borrowing. We also have bad credit car loans with guaranteed approval. Follow the tips below before starting the loan process.

Several compelling advantages come in handy with guaranteed loans if you choose us. Our objective is to provide borrower-friendly, bespoke loan offers that support your financial needs. For that, our lending approach encapsulates some potential features.

Quickloanslender is known for speedy disbursement of funds. Our online loan process aims to provide fast funding with better customisation that is impossible in traditional lending. With transparent terms, our guaranteed loan strategy makes funds accessible to people from all walks of life. You should stop worrying if you are looking for funds. Apply today and now for guaranteed loans online and erase all your financial worries.