Doorstep loans are an old-school service that works well for those who stay away from online banking. The loan agents bring all the needed papers to your home to get you loans. They take time to know the local scene and cost issues in each area. There are many towns and states where these loans are very famous, one of them is Scotland. Many prefer doorstep loans in Scotland over any bank loans for their convenience.

Many in small fishing towns and farming spots still use cash daily. The doorstep model fits neatly with this cash-based way of life. There is no need to change habits or learn new tech just to get help.

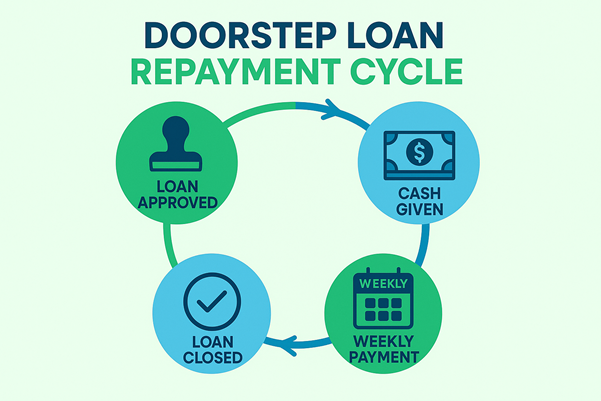

The process stays simple from start to finish with the right steps. You call, they visit, you chat, and give loans if all looks good. Your payment plans match how you get paid, whether weekly or monthly.

What Makes Doorstep Loans Different from Online Loans?

Doorstep loans are a more effective way when compared with other loans. In contrast to online ones, doorstep loans may be availed without necessarily requiring internet connectivity. A loan representative comes to your doorstep to elaborate and offer clarifications on the spot.

The conversation builds trust that websites just can’t compete with. Your representative sits down next to you, takes you through the paperwork, and ensures you understand all the conditions. They can recognise confusion and solve it right away.

This arrangement eliminates enormous blocks for individuals who lack devices or technical skills. The agent manages forms as you fill in basic information and proof of earnings. Money usually comes immediately. These are some advantages of this loan:

- Loans can be set up in about an hour

- Agents often serve the same areas for years

- Payment pickups happen at times that suit you

- Small amounts (£100-£1000) readily available

| Who Benefits Most From Doorstep Loans? | |

| Group | Why It Helps Them |

| Pensioners | No tech skills needed, cash delivered home |

| Rural residents | Saves travel to distant bank branches |

| Low-income families | Quick small loans for daily needs |

| People without a bank | Cash loan, no account needed |

| Unemployed borrowers | Easy access despite limited options |

1. Simple Process with No Tech Skills Required

You can get doorstep loans in Bradford from Quickloanslender. They cut through digital fuss with plain steps anyone can follow. The whole system works on paper forms that agents bring right to your door.

Bradford residents enjoy quick service from their local agents who know the area well. You simply show proof that you can pay back the loan. This might be wage slips or benefit letters that you already have at home.

There will be no waiting days for bank moves or standing in cash point lines. The agent counts out pounds in front of you once the papers are signed.

There is no need for tricky passwords or keeping track of login details. They are the best in Bradford and have served the town for years with this old-school approach. The agent stops by on set days to collect what you owe for repayment. This helps when questions come up about your loan balance or next steps.

2. Fast Access to Cash Without Bank Transfers

Doorstep loans solve money troubles for those who need money quickly. The loan rep brings actual cash to your living room, often within hours of your first call. This helps during any emergency.

Many people lack proper bank accounts due to past credit issues or other reasons. These home-based loans skip that hurdle entirely. You don’t need sort codes, account numbers, or bank cards.

People on benefits or cash-in-hand jobs find this path works well with their money setup. There is no need to explain why you don’t use banks or feel judged about your choices. This way of lending makes sense for urgent costs like school trips, broken fridges, or surprise bills.

| Doorstep Loans vs Other Offline Loan Options | ||||

| Option | Ease of Access | Cash in Hand | Personal Support | Cost Level |

| Doorstep loans | Very easy | Yes | Yes | Medium |

| Credit unions | Moderate | Sometimes | Yes | Low |

| Pawnbrokers | Easy | Yes | No | High |

| Employer advance | Limited | Yes | Yes | Low |

| Family borrowing | Varies | Yes | Yes | None |

3. A Good Option for Rural or Remote Areas

A small village often lacks basic money services. Many rural spots have lost their last bank branch in recent years. People in remote parts save time and travel costs with these home visits. The agent drives to you instead, even on farms or down narrow lanes where postcodes can be tricky.

This reach matters most during bad weather when roads might be rough. The loan team plans their routes to cover wide areas across the countryside. Country dwellers often face slower internet speeds.

The older village people who’ve never used computers find this method fits their lives. The same agent tends to visit each time, getting to know local needs well. This builds trust in places where word spreads quickly about good or bad service.

4. Helpful for Pensioners and Older Borrowers

Many older individuals feel that banking trends leave them behind. Many apps and online platforms update themselves with such regularity that money tasks become increasingly more difficult. The loan agent is at your kitchen table and explains every step to you clearly.

You can easily remain in your own home, no bus rides, no long waiting in cold bank halls. This is especially useful for the old people who have sore knees or a badly aching back or take a walking stick, and have to travel.

The same friendly agent is likely to visit each time and build trust over months or years. This seems safer than giving information to unknown voices on the telephone or entering data into websites.

| Pros and Cons of Doorstep Loans for Offline Borrowers | |

| Pros | Cons |

| Easy to apply at home | Higher interest rates |

| No internet or tech needed | Small loan amounts only |

| Cash given in hand quickly | Limited to local lenders |

| Weekly repayments collected | Risk of debt build-up |

| Personal support from an agent | Less privacy at home |

5. Trusted by Many Who Prefer Simple Cash Loans

This style of borrowing is familiar to many homes. Small town high streets lost their banks, but loan agents still call. The service flourishes where neighbours know one another.

These loans become part of the working-class fabric. You can also obtain loans for festive periods such as Easter and Christmas, which can stretch tight budgets. It is a reliable source of lending designed to alleviate the stress of these hectic periods. Your children still receive treats, and bills remain paid during the festive season.

6. Why Doorstep Loans Can Be the Right Choice Offline?

Most people prefer the conventional methods of obtaining loans. The agent visits you on a fixed day each week. This is convenient because you know when to be at home. You can inquire about your balance or deal with any payment concerns.

They will spell out all the terms of the loan in straightforward language without banking speak or fine print. The agent ensures you receive what you’re committing to. This saves on additional fees down the road, which could put you in the red.

Their regular visits ensure your payments are never behind schedule without bank charges or penalty fees. You can clarify if things get difficult in a week.

- No smartphone or email address needed at all

- Forms filled in for you if writing is hard

- Agents often know the local area and the cost of living

- Payment dates can fit around when your pension arrives

- Help with budgeting advice comes as part of the service

Conclusion

Doorstep loans are for those whom others tend to forget. Oftentimes, not everyone is interested in banking on screens or phone apps. Some still appreciate an open conversation about money issues in their own home.

These loans are still useful for those who have no internet connection or smart devices. These bring in money and assistance to areas where bank branches shut down years ago.

Emma Anderson is a financial advisor at Quickloanslender who always believes in researching hard to know her clients’ financial problems. She takes the time to understand their financial wants and needs to write the blogs on them as the solutions. In her long 14 years of experience, she has written plenty of blogs on the financial and business sectors of the UK.

Emma Anderson has been recognised for her work in financial planning and her blogs are regularly published in the website of Quickloanslender. As far as her educational qualification is concerned, she has done Masters in Accounting and Finance, and done PG Diploma in Creative Writing.